Table of Contents

Managing finances efficiently is the cornerstone of business sustainability. Whether you are just starting or looking to expand, applying the right small business finance tips is critical for long-term growth. At Xora, we believe smart financial practices are essential for every entrepreneur’s journey. By leveraging powerful Xora finances tools and following proven financial strategies, small businesses can overcome challenges, streamline operations, and achieve long-term success.

In this blog, we share the most practical small business finance tips every owner must know to run a thriving and financially healthy company.

1. Separate Business and Personal Finances

Keeping business and personal expenses separate is crucial for accurate bookkeeping and tax filing. Open a dedicated business account to simplify financial tracking and reporting.

2. Create a Realistic and Detailed Budget

Budgeting is one of the most important business best practices. Set monthly and yearly budgets to forecast expenses and plan investments. Always update your budget to reflect actual business performance.

3. Monitor Cash Flow: A consistently small business finance tip

Regular cash flow monitoring prevents surprises and ensures you have enough liquidity to cover operational costs. Xora’s financial management features make it easy to track and predict your cash flow.

4. Save for Taxes and Compliance

Plan ahead by setting aside a fixed percentage of your earnings for taxes. This habit shields you from financial stress during tax seasons and ensures compliance with regulations.

5. Build an Emergency Fund

Every small business should maintain an emergency fund. Unexpected repairs, supply shortages, or economic downturns can be managed better if you have savings set aside.

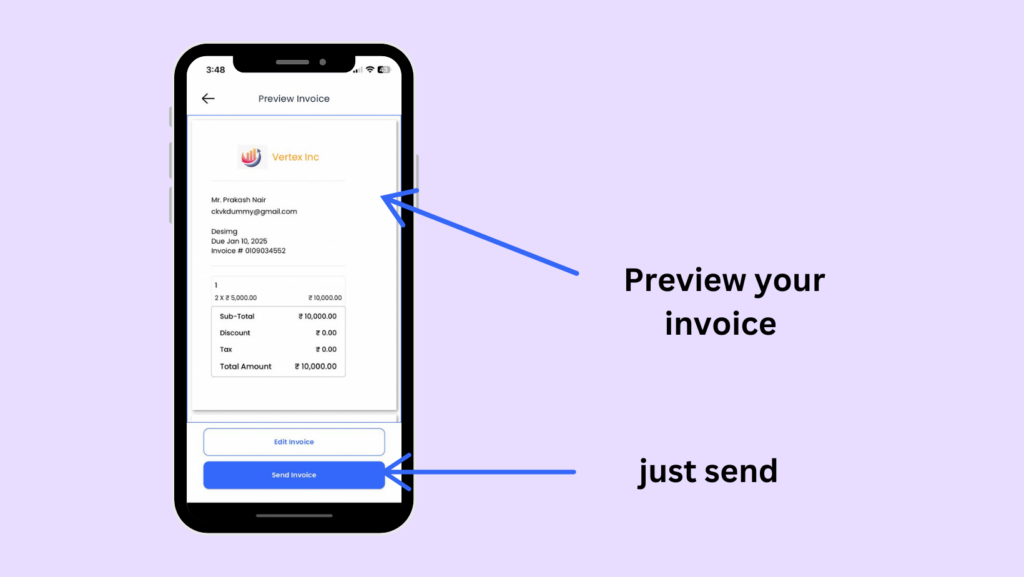

6. Automate Invoicing and Payments

Automation improves efficiency and accuracy. Use Xora to automate invoices, track payments, and send reminders—reducing delays and improving your cash inflow.

7. Utilize Robust Accounting Software

Reliable accounting software helps you manage payroll, invoices, taxes, and expenses. Xora seamlessly integrates with top accounting tools to support small businesses in maintaining financial transparency.

8. Maintain Strong Business Credit

Establishing a strong credit profile opens doors to better loan opportunities. Pay vendors and creditors on time, and manage your credit responsibly.

9. Plan Smart Investments

Before expanding or purchasing assets, evaluate the return on investment (ROI). Smart financial planning ensures that every penny you spend contributes to your business growth.

10. Consult Financial Experts

Partner with accountants or financial advisors who specialize in small business finance. Professional advice can help optimize your financial strategy, maximize deductions, and prepare for future expansion.

How Xora Helps You Manage Finances for Long-Term Success

Xora is designed to make financial management simpler and smarter for small businesses. Our tools offer:

- Automated Invoicing and Payment Tracking

- Cash Flow Monitoring

- Expense Management

- Financial Reporting

- Accounting Software Integration

By leveraging Xora’s powerful financial tools, you can strengthen your financial health and focus more on growing your business.

Conclusion

Mastering financial management is crucial for the survival and growth of any small business. By applying these small business finance tips and utilizing the right tools, you can create a strong financial foundation for your company’s future.

Xora is here to empower your journey toward long-term success with comprehensive financial solutions tailored for small businesses. Take control of your finances today, streamline your operations, and set your business on the path to sustainable growth with Xora Finances.

Ready to take the next step? Explore Xora’s financial tools and make smart money management your competitive advantage.

Leave a Reply